As digital assets like XRP mature, investors are exploring how crypto exposure fits into long-term financial planning—especially retirement. The key question? How XRP allocation impacts risk, growth potential, and overall portfolio performance. Let’s break down what smart allocation looks like, where XRP might be heading, and how to position it responsibly for your retirement future.

The Case for XRP in Tax-Advantaged Accounts: Strategy and Diversification

For most investors, XRP can’t be purchased directly inside a traditional 401(k) or IRA. However, a Self-Directed IRA (SDIRA) opens the door to crypto investments. This allows diversification beyond traditional assets while preserving tax advantages.

Holding XRP in an SDIRA can provide tax-deferred growth (traditional) or tax-free withdrawals (Roth). Just ensure you use a reputable digital asset custodian and maintain a balanced approach—crypto exposure should complement, not replace, core holdings like equities and bonds.

Determining Your XRP Allocation: How Much XRP Do You Need to Retire?

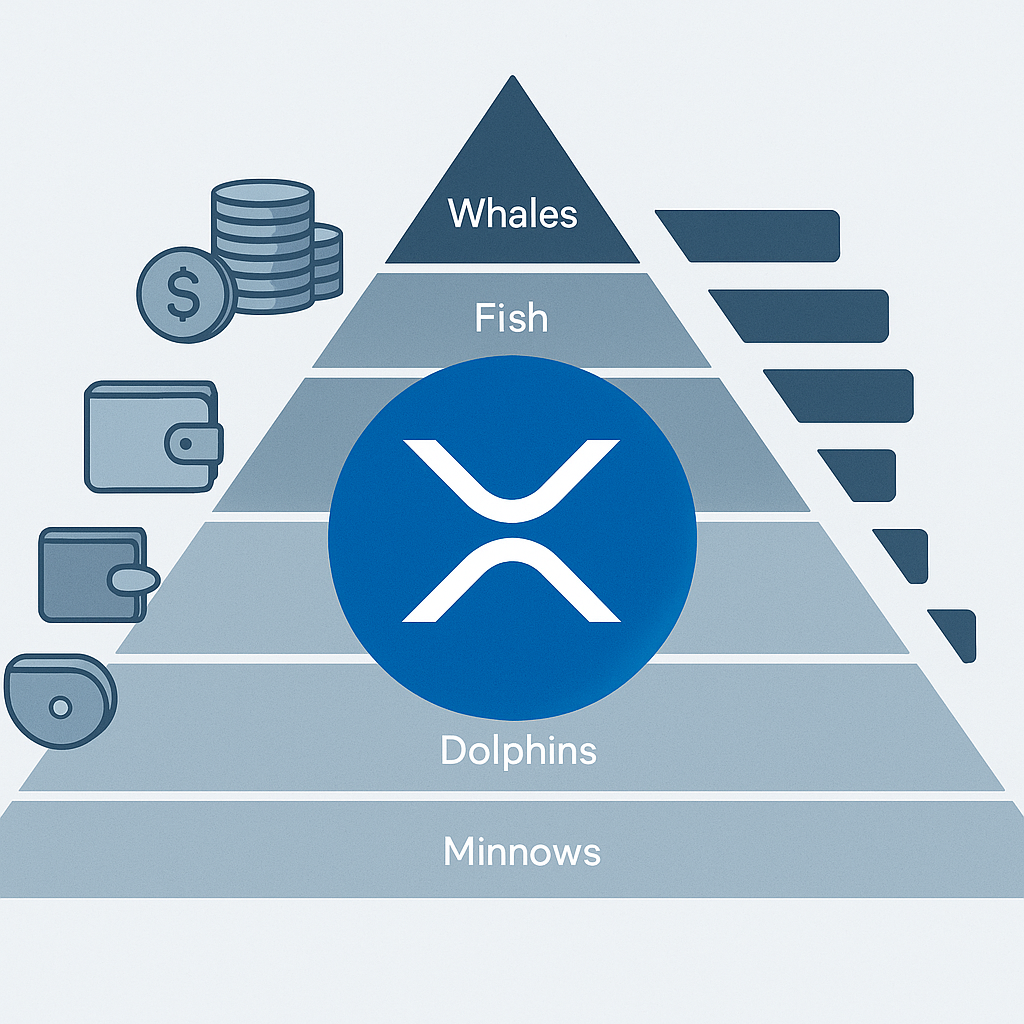

Allocating XRP in a retirement portfolio should align with your risk tolerance and time horizon.

Financial experts generally recommend a 1–5% crypto allocation, reserving higher exposure for aggressive investors. The goal is to benefit from potential appreciation without endangering retirement stability.

Curious about how much XRP you’d need to retire?

Use this simple formula:

Target Retirement Value ÷ Number of XRP Held = Required XRP Price.

For example, needing $2 million with 100,000 XRP means a $20 price target—ambitious but illustrative of the speculative nature of crypto planning.

XRP Price Prediction and Future Plans: Forecasts for 2025, 2030, and 2040

XRP price predictions vary widely. Analysts tracking XRP’s 2025 and 2030 forecasts often highlight adoption trends, Ripple’s ongoing institutional partnerships, and the impact of its role in cross-border payments.

While some forecasts are optimistic—pointing to potential revaluations if Ripple expands globally—others stress volatility and regulatory uncertainty. By 2040, if XRP achieves mainstream settlement use, its price could reflect stronger fundamentals. Still, all projections remain speculative; diversification remains your best defense.

The Critical Impact of the SEC Case on XRP’s Regulatory Future

The SEC vs. Ripple case remains one of the most significant legal events shaping XRP’s future. A favorable resolution strengthens XRP’s legitimacy as a compliant digital asset, potentially opening doors for institutional adoption and price stability. Conversely, any unfavorable outcome could restrict U.S. exchange access or dampen investor sentiment. Keep an eye on ongoing XRP news and legal developments—they’re key to understanding its long-term regulatory trajectory.

Assessing the Investment: Is XRP a Smart Investment for Your Retirement Portfolio?

XRP offers intriguing utility and long-term potential, especially within the global payments space. Yet it remains a high-volatility, high-reward asset. Treat it as a satellite holding, not a portfolio cornerstone. Balance speculative positions like XRP with reliable, income-generating investments to secure your retirement goals.

FAQs

1. Can I buy and hold XRP directly within a traditional 401(k) or IRA?

No. You’ll need a Self-Directed IRA (SDIRA) to include XRP, using a crypto custodian.

2. What is a recommended maximum allocation percentage for XRP?

Typically, 1–5% of your total retirement portfolio; up to 10% for aggressive investors.

3. How does investing in XRP via an SDIRA affect capital gains tax?

Traditional SDIRAs offer tax-deferred growth; Roth SDIRAs allow tax-free growth and withdrawals.

4. What price must XRP reach for me to retire, and is this realistic?

Use: Target Retirement Value ÷ Number of XRP Held = Required Price.

Relying solely on XRP appreciation is risky—keep your plan diversified.