Market Pulse

Metaplanet‘s recent announcement regarding a substantial $500 million Bitcoin-backed credit facility has sent ripples through the corporate finance world. In an environment increasingly accustomed to companies allocating portions of their treasuries to digital assets, this move elevates the discussion significantly. It begs a crucial question for investors and market observers alike: Is Metaplanet demonstrating a sophisticated, capital-efficient strategy for leveraging Bitcoin as a productive asset, or are we witnessing a high-stakes, momentum-driven play that could expose the company to undue risk? The implications of this approach for broader corporate adoption and Bitcoin’s evolving role as a treasury asset are profound and warrant careful scrutiny.

The Mechanics of Bitcoin-Backed Corporate Debt

The concept of using Bitcoin as collateral for traditional credit facilities is not entirely novel, with pioneers like MicroStrategy having explored similar avenues. However, a $500 million line of credit specifically for Bitcoin acquisition signifies a new scale of institutional comfort and risk appetite from lenders. Typically, such facilities allow a company to unlock liquidity from its existing or newly acquired Bitcoin holdings without divesting the asset. This enables firms to deploy capital into operations, growth initiatives, or even further Bitcoin purchases, effectively creating a leveraged position. The credit terms, including interest rates, loan-to-value (LTV) ratios, and margin call thresholds, are paramount. Lower LTVs and flexible margin call mechanisms are crucial safeguards against Bitcoin’s inherent volatility, especially for a sum of this magnitude.

Deconstructing the “Momentum Trade” Perspective

The assertion that Metaplanet’s strategy might be a ‘momentum trade’ stems from the observation that acquiring significant debt to buy a volatile asset often occurs during periods of strong upward price movement. The assumption is that the asset’s appreciation will outpace the cost of borrowing, generating outsized returns. Critics of this approach highlight the inherent risks:

- Market Volatility: A sharp downturn in Bitcoin’s price could trigger margin calls, forcing Metaplanet to either post additional collateral or liquidate assets at unfavorable prices.

- Interest Rate Sensitivity: While current rates might be manageable, future increases could significantly burden debt servicing, especially if Bitcoin’s appreciation slows.

- Concentration Risk: A substantial portion of the company’s financial health becomes tethered to a single, albeit dominant, digital asset.

Proponents, however, might argue that it’s a long-term conviction play, using debt strategically to accumulate a generational asset and enhance shareholder value without equity dilution.

Strategic Imperative or Financial Engineering?

From a more optimistic viewpoint, this move could be seen as a sophisticated piece of financial engineering designed to maximize shareholder value. By leveraging its balance sheet to acquire Bitcoin, Metaplanet is effectively making a powerful statement about its belief in Bitcoin’s long-term value proposition and its potential to serve as a superior treasury reserve asset compared to traditional fiat holdings. This strategy could be driven by several factors:

- Capital Efficiency: Utilizing dormant Bitcoin as collateral frees up operational capital.

- Inflation Hedge: Positioning against potential future fiat currency devaluation.

- Avoiding Dilution: Raising capital through debt rather than issuing new shares preserves equity value for existing shareholders.

The key differentiation lies in the intent – is it a short-term bet on immediate price appreciation, or a calculated, long-term strategic allocation within a robust risk management framework?

Implications for Corporate Bitcoin Adoption

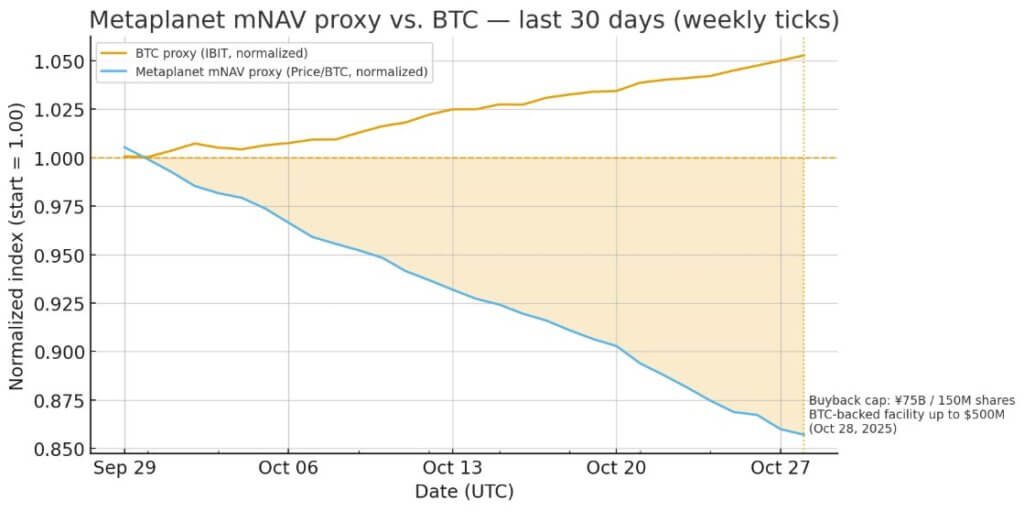

Metaplanet’s decision could serve as a bellwether for other corporations observing the evolving landscape of digital asset integration. If this strategy proves successful in navigating market cycles and enhancing financial performance, it could encourage more conservative treasuries to explore similar, albeit perhaps less aggressive, avenues for Bitcoin exposure and leverage. Conversely, any significant misstep or adverse market reaction could reinforce skepticism and delay broader institutional adoption of such advanced treasury strategies. The financial community will undoubtedly be watching Metaplanet’s quarterly reports with heightened interest, scrutinizing its debt servicing capacity and the performance of its Bitcoin holdings against market benchmarks.

Conclusion

Metaplanet’s $500 million Bitcoin-backed credit facility represents a pivotal moment in the ongoing narrative of corporate Bitcoin integration. It embodies both the innovative potential for capital efficiency and the inherent risks associated with leveraging volatile assets. While the long-term success of this strategy remains to be seen, it underscores the growing complexity and sophistication within crypto-financial markets. For now, the verdict on whether this is a shrewd strategic play or a precarious momentum trade is still out, but it undeniably sets a new precedent for how corporations might engage with Bitcoin in the future, demanding careful observation and robust risk assessment from all stakeholders.

Pros (Bullish Points)

- Enables access to capital without selling core Bitcoin holdings.

- Potentially amplifies returns if Bitcoin appreciates significantly.

- Avoids equity dilution for capital raising.

- Signals strong corporate confidence in Bitcoin's long-term value.

Cons (Bearish Points)

- Exposes the company to extreme market volatility and potential margin calls.

- Increases debt burden and interest rate risk.

- Strategy failure could lead to significant financial and reputational damage.

- Concentrates corporate treasury risk in a single, volatile asset.

Frequently Asked Questions

What is a Bitcoin-backed credit facility?

It's a loan where a company uses its Bitcoin holdings as collateral, allowing access to fiat capital without selling the BTC.

What are the main risks for Metaplanet with this strategy?

Key risks include Bitcoin price volatility triggering margin calls, increased debt servicing costs, and concentration risk in a single asset.

How does this differ from simply buying Bitcoin directly?

It differs by adding leverage; the company takes on debt to potentially acquire more Bitcoin or use the capital, amplifying both potential gains and losses compared to a direct, unleveraged purchase.