Market Pulse

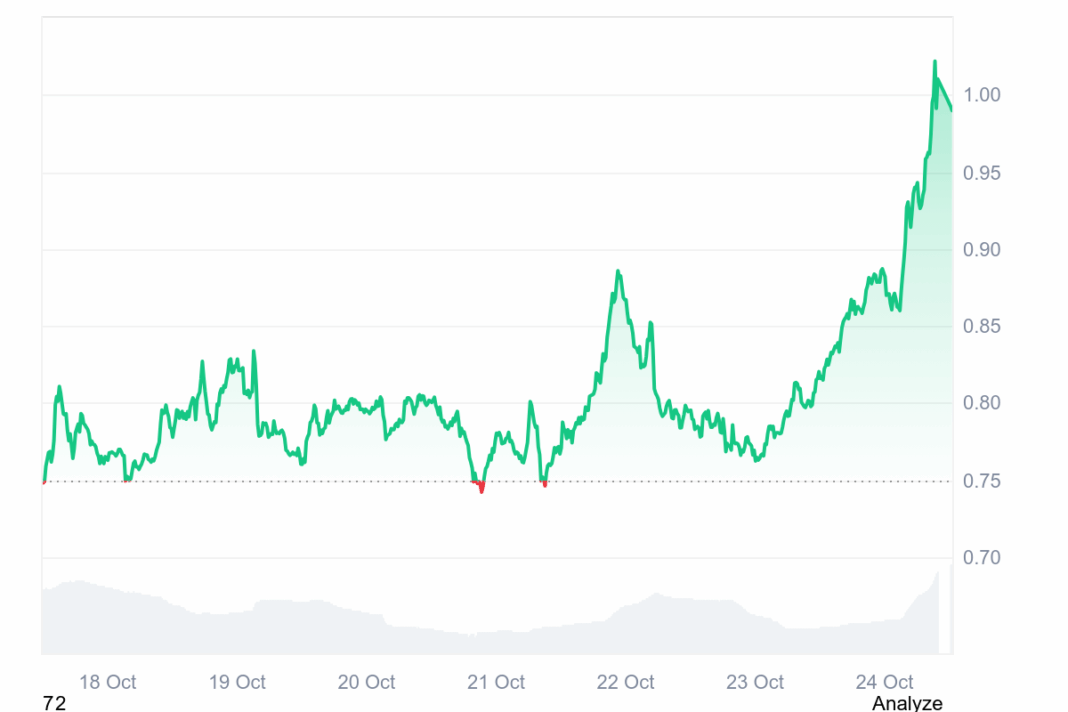

October 24, 2025, marks a significant milestone for the Decentralized Finance (DeFi) sector, specifically within the TRON ecosystem, as JustLend DAO officially announced the successful completion of its first JST token buyback and burn. This highly anticipated event is not merely a transaction; it represents a strategic pivot towards a revenue-driven deflationary model, promising to reshape the economic landscape for JST holders and potentially setting a new precedent for sustainability within lending protocols. As the crypto market matures, the focus on tangible value creation and supply-side economics becomes paramount, and JustLend’s move is a bold step in that direction.

The Mechanics of a New Deflationary Era

At its core, the JST buyback and burn mechanism is straightforward: a portion of the revenue generated by the JustLend protocol is used to repurchase JST tokens from the open market, which are then permanently removed from circulation. This initial burn signals the commencement of a continuous process designed to reduce the overall supply of JST over time. Unlike inflationary models, or even fixed-supply tokens, this revenue-driven approach directly ties the token’s scarcity to the actual utility and profitability of the underlying protocol. This ensures that as JustLend thrives and generates more fees from lending and borrowing activities, the deflationary pressure on JST intensifies, creating a symbiotic relationship between protocol success and token value.

Strengthening JST’s Value Proposition

For investors and long-term holders, the initiation of a deflationary cycle is typically a bullish signal. By reducing the circulating supply, JustLend aims to increase the scarcity of JST, which, assuming stable or increasing demand, should exert upward pressure on its price. This move reflects a commitment to enhancing shareholder value and fostering a sustainable token economy. Moreover, it positions JST as a value-accrual asset directly benefiting from the operational success of one of TRON’s most prominent DeFi applications. The benefits for JST holders are multi-faceted:

- Increased Scarcity: Fewer tokens in circulation means each remaining token represents a larger share of the total supply.

- Revenue Alignment: Token value is now directly linked to the robust performance and fee generation of the JustLend protocol.

- Long-Term Holder Incentive: Provides a strong incentive for investors to ‘HODL’ JST, anticipating future value appreciation from continued burns.

- Ecosystem Confidence: Signals maturity and financial prudence from the JustLend DAO, instilling greater trust within the community.

Broader Implications for the TRON Ecosystem

JustLend is a cornerstone of the TRON blockchain’s DeFi landscape. Its move towards a revenue-driven deflationary model for JST could have significant ripple effects across the entire ecosystem. It serves as a strong signal of TRON’s commitment to fostering robust and sustainable DeFi applications. Other protocols within the TRON network, and indeed across the broader crypto space, will be keenly observing the long-term success of this strategy. If proven effective, it could inspire a wave of similar tokenomic adjustments, favoring models that prioritize value capture and supply reduction over purely inflationary reward mechanisms. This enhances TRON’s appeal as a platform for financially sound and innovative DeFi projects.

Conclusion

The completion of JustLend DAO’s first JST buyback and burn is more than just a procedural event; it’s a declarative statement about the protocol’s future and its role in the evolving DeFi narrative. By cementing a revenue-driven deflationary cycle, JustLend is not only attempting to secure the long-term value of its native token but also demonstrating a viable path towards sustainable tokenomics for the broader industry. As the crypto market continues to seek mature and value-accruing mechanisms, JustLend’s proactive approach positions it as a key player to watch, potentially ushering in a new standard for how DeFi protocols manage their token supply and drive economic growth in the years to come.

Pros (Bullish Points)

- Reduced token supply can lead to increased scarcity and potential price appreciation for JST.

- Demonstrates a commitment to sustainable tokenomics, funded directly by protocol revenue.

- Enhances confidence in JustLend and the broader TRON DeFi ecosystem by aligning incentives.

Cons (Bearish Points)

- The long-term impact on price depends on sustained protocol revenue and adoption, which isn't guaranteed.

- Initial burns might be small relative to total supply, requiring sustained effort for significant impact.

- Market sentiment can still be influenced by broader crypto trends, overshadowing specific tokenomics.

Frequently Asked Questions

What is the JST buyback and burn program?

It's a mechanism where JustLend DAO uses a portion of its protocol revenue to buy JST tokens from the open market and permanently remove them from circulation, aiming to reduce supply.

How does this impact JST token holders?

By reducing the total supply of JST, the buyback and burn program aims to increase the scarcity of the token, potentially leading to appreciation in its value over time for holders.

What is the long-term goal of JustLend's deflationary strategy?

The goal is to create a sustainable, revenue-driven deflationary model for JST, aligning the token's value with the success and profitability of the JustLend protocol and enhancing its appeal.