Market Pulse

The decentralized exchange (DEX) sector has reached an unprecedented milestone, recording over $1 trillion in monthly trading volume. This significant achievement, observed in October 2025, underscores the accelerating maturation and increasing mainstream adoption of decentralized finance (DeFi). However, this surge has occurred amidst a period of notable market volatility, prompting a cautious and analytical perspective on the sustainability and implications of such rapid growth within the inherently risk-prone crypto landscape.

The Trillion-Dollar Milestone: A Testament to DeFi’s Growth

Surpassing the $1 trillion mark in a single month is a powerful indicator of the liquidity and user activity migrating towards decentralized platforms. This milestone suggests several underlying trends:

- Increased User Confidence: A growing number of traders and investors are comfortable utilizing DEXs for significant capital allocation.

- Enhanced Liquidity: Improved liquidity pools and aggregated liquidity solutions have made larger trades more feasible without significant slippage.

- Protocol Innovation: Continuous development in DEX architectures, including advancements in Automated Market Makers (AMMs) and hybrid models, has improved efficiency and user experience.

- Reduced Centralization Risk: The appeal of self-custody and censorship resistance continues to draw users wary of centralized exchange vulnerabilities or regulatory pressures.

While impressive, it’s crucial to contextualize this growth. The total trading volume across all crypto markets has also seen a general uptick, but the DEXs’ share of this volume indicates a disproportionate rise in decentralized activity.

Read more: Crypto.com’s Bold Move: Seeking U.S. Banking License to Reshape Digital Finance

Decoding the Volatility Factor: Opportunity and Risk

The headline itself links the volume surge with market volatility. This connection is not coincidental; volatility often acts as a catalyst for increased trading activity on DEXs:

- Arbitrage Opportunities: Price discrepancies across various centralized and decentralized exchanges become more pronounced during volatile periods, creating fertile ground for arbitrage bots and traders.

- Rapid Asset Swaps: Users may quickly rotate assets in response to market movements, leveraging the immediate settlement and wide array of token pairs available on DEXs.

- Speculative Trading: High volatility attracts speculative traders looking to capitalize on rapid price swings, contributing significantly to volume.

However, this symbiosis also presents substantial risks. Increased volatility can lead to greater impermanent loss for liquidity providers, heightened slippage for large orders, and more rapid liquidations for leveraged positions on platforms offering such services. The ‘wild west’ nature of some DEX environments means users must exercise extreme caution.

Evolving DEX Landscape and Regulatory Scrutiny

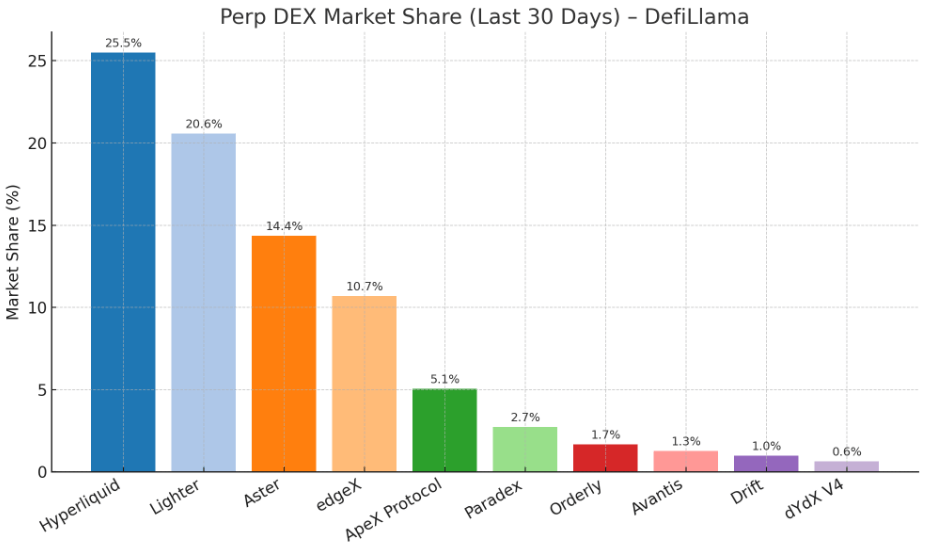

The DEX ecosystem is far from monolithic. It encompasses a diverse range of protocols, from established AMMs like Uniswap and Curve to emerging order-book models and specialized derivatives platforms. This innovation is driving the sector forward, yet it also attracts increasing attention from regulators globally. As transaction volumes soar, so does the potential for illicit activities and the calls for greater oversight.

Jurisdictions are grappling with how to classify and regulate decentralized entities, particularly concerning KYC/AML compliance. The future trajectory of DEX growth may well depend on a delicate balance between preserving decentralization and adhering to evolving global financial standards, potentially leading to more ‘permissioned’ DeFi protocols.

Investor Implications and Future Outlook

For investors, the $1 trillion monthly volume signifies a robust and increasingly liquid market segment. However, participation demands a high degree of technical proficiency and risk awareness. The underlying infrastructure, while improving, still carries smart contract risks, and the decentralized nature can make recourse difficult in case of errors or exploits.

Looking ahead to late 2025 and beyond, DEXs are poised for continued innovation. We anticipate further advancements in cross-chain interoperability, enhanced user interfaces, and potentially more institutional participation as regulatory clarity improves. Yet, the inherent risks associated with high volatility and evolving regulatory landscapes remain paramount considerations for anyone engaging with this burgeoning sector.

Conclusion

The achievement of $1 trillion in monthly trading volume for decentralized exchanges is an undeniable testament to the sector’s incredible growth and its pivotal role in the future of finance. It highlights a clear user preference for self-custody and censorship resistance. However, the concurrent spike in market volatility serves as a critical reminder that while opportunity abounds, so too does risk. A balanced, analytical approach, prioritizing robust risk management and due diligence, remains essential for navigating this exciting yet unpredictable facet of the crypto market.

Pros (Bullish Points)

- Demonstrates robust growth and increasing adoption of decentralized finance, validating the DEX model.

- Increased liquidity on DEXs can lead to more efficient markets and better price execution for traders.

Cons (Bearish Points)

- The surge is tied to high market volatility, increasing risks for liquidity providers (impermanent loss) and traders (slippage, rapid liquidations).

- Heightened volumes amidst volatility may attract increased regulatory scrutiny, potentially leading to more restrictive operating environments for DEXs.

Frequently Asked Questions

What is a decentralized exchange (DEX)?

A DEX is a cryptocurrency exchange that operates without a central authority, allowing users to trade directly from their wallets through smart contracts, emphasizing self-custody and censorship resistance.

Why did DEX trading volume increase significantly?

The volume surge is attributed to growing user confidence in DeFi, improved liquidity solutions, continuous protocol innovation, and notably, increased market volatility which creates more trading and arbitrage opportunities.

What are the main risks of trading on DEXs during high volatility?

Key risks include impermanent loss for liquidity providers, higher slippage on large trades, potential for rapid liquidations, and smart contract vulnerabilities.